Cap Rates

With interest rates rising, it’s time to take another look at cap rates. The cap rate ratio is commonly used in commercial real estate and is useful in a number of situations. The low cap rates probably won’t last as Treasury yields rise, said Alfonso Munk, chief investment officer of Americas, Prudential Real Estate Investors.

With interest rates rising, it’s time to take another look at cap rates. The cap rate ratio is commonly used in commercial real estate and is useful in a number of situations. The low cap rates probably won’t last as Treasury yields rise, said Alfonso Munk, chief investment officer of Americas, Prudential Real Estate Investors.

“There’s a probability that 12 months from now that prices will go down and it’s normal. If it goes down 10 percent, said Munk. Then it’s not bad compared to the equities. We will be fine as long as we aren’t over-leveraged. Those crazy cap rates will get back to normal because they are unsustainable.”

Many of the foreign investors that contributed to the run-up in real estate values have been pulling back, Munk said. That’s actually a good thing because many of them just wanted to park their capital in the U.S. regardless of the returns, he said.

What are Cap Rates?

Investopedia describes capitalization rate (cap rates) as “the rate of return on a real estate investment property based on the income that the property is expected to generate. We use the capitalization rate to estimate the investor’s potential return on his or her investment.

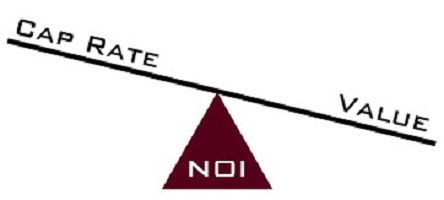

“The capitalization rate of an investment may be calculated by dividing the investment’s net operating income (NOI) by the current market value of the property, where NOI is the annual return on the property minus all operating costs. We can use the following formula to calculate the capitalization rate:

“Capitalization Rate = Net Operating Income / Current Market Value”

There is a relationship between interest rates and cap rates. If interest rates increase, you would expect to pay a higher cap rate for the same income stream. If interest rates increase because of inflation increasing, the value of your property will increase, and you must get an increase in rents or higher NOI enough to keep the cap rate flat.

You can use a cap rate to judge whether a property is over or underpriced compared to similar properties. Take a rental house. If the house is $450,000 and net rent is $1500 per month, the cap rate is 4%. If a similar house is $450,000 and net rent is $1000, the cap rate is 2.7%. The second house is more expensive. It might also mean that if the rent can be raised, the cap rate would increase would increase by 50%.

You can also judge the returns available in various investments. If Bank rates on CDs were 10%, and cap rates were 6%, bank CDs would be a better return with less risk. Today with bank CDs at 1%, even real estate cap rates at 2.6% look good. Cap rates at 10% would be heavenly.

What if Rates Rise?

Lately, the Federal Reserve has raised rates; the 10-year Treasury has gone up quite a bit. In July 2016 the 10-year hit a low of 1.37%. It closed yesterday at 2.77% on February 6, 2018. That means we need to take another look at cap rates.

If interest rates rise, a decline in the retail price of a property will follow which would raise the cap rate. Rising interest rates are a signal not to pay as much for the property or a signal that rents must go up to be in line with the new interest rates.

We will send you FREE information about How to Sell Your House Fast.

Harmony Property Solutions, LLC is here to help homeowners out of any distressed situation. As investors, we are in business to make a modest profit on any deal. However, we can help homeowners out of just about any situation, no matter what! There are no fees, upfront costs, commissions, or anything else. Just the simple, truth about your home and how we pay cash for houses Cedar Rapids.