Have You Saved Enough for Retirement?

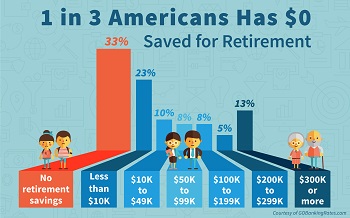

Have you saved enough for retirement? Every time I read financial publications about how much money is needed in retirement, I find most of us are woefully unprepared. Many have put away nothing or very little to carry them through their retirement years. Cedar Rapids residents are no exception. Even if you have managed to save, the interest rates on savings don’t keep up with inflation.

Have you saved enough for retirement? Every time I read financial publications about how much money is needed in retirement, I find most of us are woefully unprepared. Many have put away nothing or very little to carry them through their retirement years. Cedar Rapids residents are no exception. Even if you have managed to save, the interest rates on savings don’t keep up with inflation.

It used to be that the older you were, the more you should move assets into fixed income, like corporate bonds, treasury bonds, and utilities with dividends. With the Federal Reserve policy of zero interest rates (ZIRP), that is no longer an option. The interest you receive is eaten up by taxes and inflation.

Have You Saved Enough for Retirement?

Miriam Caldwell at AboutMoney was asked the question, Is real estate a good investment? She answered that real estate is a great investment option. It can generate an ongoing source of income. It can also rise in value over time and can prove a good investment as it builds equity. You may use it as a part of your overall strategy to begin building wealth.

However, you need to be sure that you are financially ready to begin investing in real estate. That means paying off credit cards, paying off student loans, and even paying off the mortgage on the house. You want to be as debt free as possible.

Build a Portfolio of Income-producing Properties

I suspect retirement is a little late to start learning about flipping houses and rehabbing, and building spec homes A mistake made here can set you back with few years left to recover. Building a portfolio of income-producing properties, however, might be easier especially for one nearing retirement. Not only do you have the cash flow, which you can use to pay off debt, but you have the years to benefit from inflation.

Besides owning a portfolio of income-producing properties, what may be just right for retirees is hard money lending. A hard money loan is a specific type of asset-based loan financing through which a borrower receives funds secured by real property. Hard money loans are typically issued by private investors or companies. Interest rates are typically higher than conventional commercial or residential property loans because of the higher risk and shorter duration of the loan. Most hard money loans are used for projects lasting from a few months to a few years.

We will send you FREE information about How to Sell Your House Fast.

Harmony Property Solutions, LLC is here to help homeowners out of any distressed situation.

As investors, we are in business to make a modest profit on any deal. However, we can help homeowners out of just about any situation, no matter what! There are no fees, upfront costs, commissions, or anything else. Just the simple truth about your home and how we can help you sell it fast to resolve any situation.

Harmony Property Solutions, LLC is part of a nationwide group of thousands of investors who are helping tens of thousands of homeowners every year. We may not be the “traditional” route, but we can help, and we can do it quickly!

Give us a call today at 319-343-6773 to let us know how we can help YOU.