Avoid Cedar Rapids Foreclosure

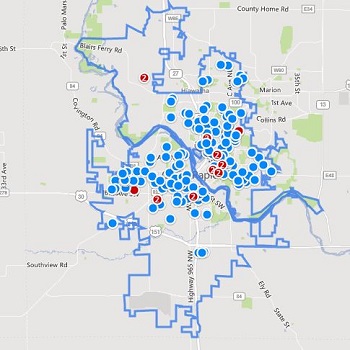

Currently, according to Zillow, the owners of almost 200 homes are in danger of losing their homes. Many have already failed to avoid Cedar Rapids foreclosure.

Currently, according to Zillow, the owners of almost 200 homes are in danger of losing their homes. Many have already failed to avoid Cedar Rapids foreclosure.

Foreclosure didn’t just suddenly appear on your doorstep like a long lost relative after winning the lottery. Like tornados, there are signs of approaching trouble, including:

- having difficulty paying the mortgage payment on time

- having very little savings for emergencies

- using credit cards to get to the next pay day

- paying the minimum on your credit cards

- neglecting doctor and dental visits

- shrinking from the ring of the phone

- change in employment or change in debt to income ratio

If you experiencing troubles like those on the list, you may be facing possible foreclosure. Here’s what to do:

- Contact your lender and level with them. They want to help you avoid Cedar Rapids foreclosure. They may be nervous by the extent of your problem, but they have seen this before and will demand you take steps to fix it.

- Don’t ignore your mail. Many have been in your shoes. The first thing many did when the mail came was throw the bills in a drawer. Those first envelopes will contain helpful suggestions to get things under control. Then will come legal action. Ignoring those notices can cause you to lose everything.

- Know the Process of Foreclosure: If you miss a few mortgage payments you are in default. Your mortgage servicer will probably send a letter or two reminding you to get caught up. They will also call you to try to collect the payments. When the lender issues a notice of default, you will have not less than 30 days to cure the default. You can cure the default by bringing the loan current with the lender and paying the late fees. Keep in mind if you do nothing, it usually takes approximately 60-90 days to effectuate an uncontested non-judicial foreclosure.

- Know the foreclosure process. The foreclosing party must mail notice of default and right to cure (reinstate) to the borrower at least 30 days before filing suit (or 45 days if the property is agricultural). The lender can demand payment of the balance 14 days before filing suit, along with a notice about counseling and mediation. To officially start the foreclosure, the lender files a lawsuit in court and serves borrower a summons and complaint. In Iowa the most common form of foreclosure is judicial and can proceed fairly rapidly if you do not respond.

- Contact Professionals – Your banker does not want to own your house. When you come clean about your financial situation, he may be able to modify the loan, offer forbearance or give you repayment options. Loan modification could include a reduction of the interest rate, convert from a variable interest rate to a fixed interest rate, or extend of the length of the term of the loan. While a loan modification agreement is a permanent solution to unaffordable monthly payments, a forbearance agreement provides short-term relief for borrowers. With a forbearance agreement, the lender agrees to reduce or suspend mortgage payments for a certain period of time and not to initiate a foreclosure during the forbearance period. Pre-payment options could include a plan to repay missed payments in addition to making monthly payments, especially if there is a temporary hardship

- Contact a credit counselor. The objective of most credit counseling is to help the creditor avoid bankruptcy, as well as provide basic education on financial management. Many counseling services also negotiate with creditors on behalf of the borrower to reduce interest rates and late fees.

- Contact a bankruptcy attorney. That sounds contrary to taking responsibility, but you need to know your options so you can make informed decisions.

- Contact a professional real estate investor. You may want to sell your home fast to get out of the problem or to save your credit rating. Harmony Property Solutions, LLC is here to help homeowners avoid Cedar Rapids foreclosure. As investors, we can help homeowners out of just about any situation, no matter what! There are no fees, up-front costs, commissions, or anything else. Just the simple honest truth about your home and how we can help you sell it fast to resolve any situation.

In summary, recognize approaching trouble, contact your lender, and seek professional help.

Harmony Property Solutions, LLC is here to help homeowners out of any kind of distressed situation. As investors, we are in business to make a modest profit on any deal, however we can help homeowners out of just about any situation, no matter what! There are no fees, upfront costs, commissions, or anything else. Just the simple honest truth about your home and how we can help you sell it fast to resolve any situation.

Harmony Property Solutions, LLC is part of a nationwide group of thousands of investors who are helping tens of thousands of homeowners every year. We may not be the “traditional” route, but we CAN help and we can do it quickly!

Give us a call today at 319-343-6773 to let us know what YOU need help with!