Opportunity Zones

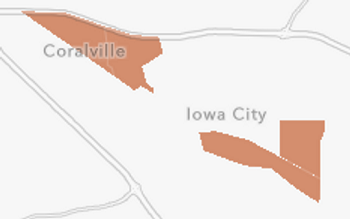

According to the Iowa City Press-Citizen, “On Thursday, the Iowa City Area Development Group was angling to get more investors to take full advantage of the Opportunity Zones in Iowa City and Coralville.”

Welcome to Opportunity Zones a program created in the 2017 tax overhaul to spur economic development in low-income neighborhoods while offering investors potentially large tax breaks.

The program has not received much publicity in the media, but investors around the country are poised to funnel billions of dollars into funds targeting developments and businesses in low-income neighborhoods.

Opportunity Zones – Urban Renewal for America

The Opportunity Zone program was created to revitalize economically distressed communities using private investments rather than taxpayer dollars. To stimulate private participation in the Opportunity Zone program, taxpayers who invest in Qualified Opportunity Zones are eligible to benefit from capital gains tax incentives available exclusively through the program.Welcome to Opportunity Zones

To qualify for nomination as an Opportunity Zone, a census tract must meet the following low-income requirements as defined by US Internal Revenue Code Section 45D(e):

- A poverty rate of at least 20%; or

- A median family income of:

- No more than 80% of the statewide median family income for census tracts within non-metropolitan areas.

- No more than 80% of the greater statewide median family income or the overall metropolitan median family income for census tracts within metropolitan areas.

Under this scope, 57% of all neighborhoods in America were up for consideration as Opportunity Zones, according to the Brookings Institute.

Essentially, Opportunity Funds can only invest in the construction of new buildings and the substantial improvement of existing unused buildings. If an Opportunity Fund invests in the improvement of an existing building, it must invest more in the improvement of the building than it paid to buy the building. Whether the building is constructed from the ground up or improved, the development of the building must be completed within 30 months of purchase.

How Can a Real Estate Investor Benefit?

When an investor divests an appreciated asset, such as stocks or real estate, they realize a capital gain, which is a taxable event. Under the Opportunity Zone Program, if an investor reinvests a capital gain into an Opportunity Fund, they can defer the taxes until April 2027 and reduce their tax liability on that gain. Beyond that, they can also potentially receive tax-free treatment for all future appreciation earned through the fund. Together, these tax incentives can boost after-tax returns for Opportunity Fund investors:

Those who hold their Opportunity Fund investment for at least 10 years can expect to pay no capital gains taxes on any appreciation in their Opportunity Fund investment.

The first Opportunity Zone was created in Vicksburg, a city where 68 percent of the population is black or African American. And even though mayor Flaggs is a Democrat, he did not hesitate to share the stage with Trump or to tout the success of the new program.

We will send you FREE information about How to Sell Your House Fast.

Harmony Property Solutions, LLC is here to help homeowners out of any distressed situation. As investors, we are in business to make a modest profit on any deal. However, we can help homeowners out of just about any situation, no matter what! There are no fees, upfront costs, commissions, or anything else. Just the simple, truth about your home and how we pay cash for houses Cedar Rapids.

Harmony Property Solutions, LLC is part of a nationwide group of thousands of investors who are helping tens of thousands of homeowners every year. We may not be the “traditional” route, but we CAN help, and we can do it quickly!

Give us a call today at 319-343-6773 to let us know how we can help YOU.